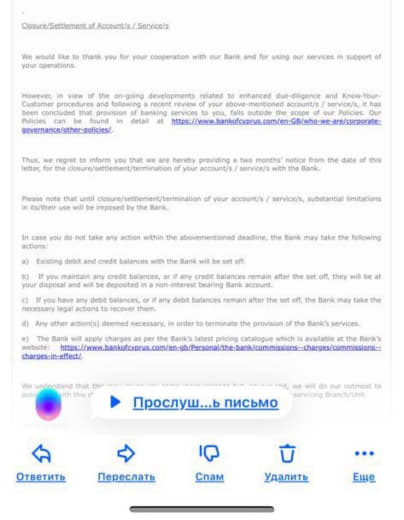

если интересно, вот выдержка из их email по этому поводу:

We would like to inform you that according to the General Healthcare System (GHS) legislation, the obligation of paying contributions for the GHS is valid for all individuals that receive income and is independent from their right of enrolling as beneficiaries.

Through the following link you can find the Contributors’ Categories, and also the contribution rates for each category https://www.gesy.org.cy/sites/Sites?d=Desktop&locale=en_US&lookuphost=/en-us/&lookuppage=hiofinancing.

In case someone works or receives an income in Cyprus, the contributions for the GHS are automatically made through the employer to the social insurance department, or in case the person is self-employed or has other incomes according to their declaration to the tax department, the contributions are imposed by the tax department and must be paid there.

Please also note that according to the criteria set by the GHS law, EU citizens who have their ordinary residence in the areas controlled by the Cyprus Government are beneficiaries when the following conditions apply:

1. Work in the areas controlled by the Cyprus Government or

2. Have acquired the right of Permanent Residence (MEU3 permit) or

3. Are Family members (spouse, child) of a GHS Beneficiary or

4. Meet the provisions of EU Regulation 883 (S1 holders)

Furthermore, for 3rd country Nationals (non-EU citizens) that reside in the areas that are controlled by the Republic of Cyprus, are GHS beneficiaries if:

a) Work in the areas controlled by the Cyprus Government, or

b) Have acquired the right of Permanent Residence (MEU3 permit), or

c) Have been granted refugee or supplementary protection status, or

d) Are Family members (spouse, child) of a GHS Beneficiary or

e) Meet the provisions of EU Regulation 883 (S1 holders).