CY Law, Visas, Taxes, Insurance

Previous messages

И то и то. Только замена уже Кипрских.

https://cypruscar.org/driving/obmen-voditelskih-prav-rf-na-voditelskoe-udostoverenie-respubliki-kipr/

Next messages

22 June 2021

Д

12:44

Deleted account

In reply to this message

У меня получилось только с третьего раза, только заказным письмом по почте. Но что-то больше никто такого не отписывал.

RK

OR

Д

OR

12:48

Deleted account

In reply to this message

Я письмом, не заказным, через мигрейшен Лимассола отправили.

12:49

In reply to this message

Потом через полгода был в Никосии - проверял как дела, нашли мои доки, сказали что "ждите".

В итоге примерно через год вернули на счет в банке. Как раз когда гарантия закончилась - это была 2х летняя старая.

В итоге примерно через год вернули на счет в банке. Как раз когда гарантия закончилась - это была 2х летняя старая.

EM

14:09

Deleted account

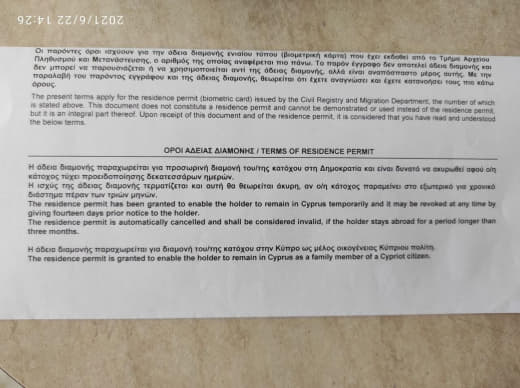

Подскажите пожалуйста, кто знает: подали на продление residence permit в начале апреля (мне по работе, жена и дети как family reunion), и 28 апреля улетели в Россию. Моя виза готова (я вернулся в мае), жена и дети остались в РФ с ресиптами. Планировали вернуться 24 июня (чуть меньше двух месяцев) но приходится задержаться ещё. Сколько можно находиться вне Кипра чтобы Пермит таки выдали им по прилёту/не отозвали? Если вернутся 19 июля (примерно 80 дней с отлёта) - это проходит? (Последний раз вылетали до этого с острова в 2019 году). Заранее спасибо

N

EM

14:17

Deleted account

In reply to this message

Т.е. если будет 80-81 день это должно пройти, так? Есть у кого-то может ссылка на документ где это описано? Буду очень благодарен

N

14:17

Deleted account

In reply to this message

да, всё будет в порядке

всё это описано в бумаге, которая приходит по почте после одобрения ВНЖ

всё это описано в бумаге, которая приходит по почте после одобрения ВНЖ

EM

14:19

Deleted account

Ни разу не получал бумагу. Может у кого есть фото?

N

EM

14:35

И ещё вопрос - эти 90 дней за границей - даются на год? Т.е. можно ли будет через 3 месяца ещё на 2 недели улететь или нужно ждать 9 месяцев прежде чем можно куда-то лететь снова?

AB

14:36

Deleted account

In reply to this message

Нельзя отсутствовать 90 дней подряд. Это не агрегатный период

EM

N

14:59

Deleted account

Кому интересно про гражданство супругов киприотов - сейчас рассматривают 2019 год (в рандомном порядке, т.е. не по порядку месяцев)

Д

N

15:01

Deleted account

In reply to this message

при подаче обещали, что в течении 12 месяцев рассмотрят

но скандалы + короновирус внесли свою лепту

но скандалы + короновирус внесли свою лепту

ВC

N

Л

15:24

Deleted account

Здравствуйте! Кто знаком хорошо с переводами из Германии? Как лучше всего деньги на Кипр переводить. Может быть кто подскажет?🙏🏻

Д

A

Д

15:36

Deleted account

In reply to this message

2 рабочих дня - это жёсткий максимум, всё зависит от банков.

A

15:37

Deleted account

In reply to this message

Согласен но у меня лично на карту в люксембург 2 дня идёт и сюда на банк кипра и хеленик банк 2 дня шло. Но это не страшно, главно приходит 😃

15:38

В россии проще, там перевод на номер карты можно, приход моментальный а в Германии так не катит 🤷♂ только S€PA

Д

15:43

Deleted account

In reply to this message

В России по номеру телефона можно в банкомат, по qr коду снять. Германии ещё далеко до этого.

A

S

16:10

Deleted account

In reply to this message

А всякие переводы с карты на карту типа paysend внутри ЕС не работают?

M

S

Д

S

M

16:12

Deleted account

In reply to this message

от банков и их лимитов. Технически это не перевод, а покупка/зачисление от юрлица. Но мне кажется это тема другой группы

Д

EG

16:14

Deleted account

Кто на non-domiciled подавал, подскажите, плз: кроме форм TD038, TD038Q и указанных в них подтверждающих документов (документов подтверждающих факт рождения родителей не на Кипре), у вас просили еще что-нибудь?

Свое свидетельство о рождении нужно подавать?

Свое свидетельство о рождении нужно подавать?

Д

16:14

Deleted account

In reply to this message

Типы карты дебит / кредит, валюта, система Visa / Master, страна выдачи и т.д.

M

16:14

Deleted account

In reply to this message

не знаю, но я привык что постоянно я не туда отвечаю и меня бьют

Д

O

16:16

Deleted account

Если из Украины деньги на BoC пересылают, как долго они зачисляются? Через Iban/swift Кто знает

EG

16:21

Deleted account

In reply to this message

Заверенный перевод?

С отцом, кстати, тоже проблема: мать-одиночка, в св-ве о рождении указан человек документов по которому нет. Я даже не знаю был ли он жив на момент моего рождения. Поэтому собираюсь указать что не был... Св-во о смерти не попросят?

С отцом, кстати, тоже проблема: мать-одиночка, в св-ве о рождении указан человек документов по которому нет. Я даже не знаю был ли он жив на момент моего рождения. Поэтому собираюсь указать что не был... Св-во о смерти не попросят?

Л

16:24

Deleted account

In reply to this message

Спасибо большое!🙏🏻 Никогда про него не слышала. Сейчас пойду изучать!

Д

16:25

Deleted account

In reply to this message

У меня был заверенный.

А как в вашей ситуации лично не знаю, но поиск вам должен помочь. Такое уже было.

А как в вашей ситуации лично не знаю, но поиск вам должен помочь. Такое уже было.

PM

17:06

Deleted account

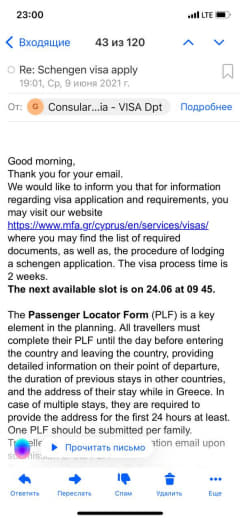

Кто-нибудь делал недавно шенген в Грецию?

В посольство не дозвониться, на емейлы не отвечают

В посольство не дозвониться, на емейлы не отвечают

Д

PM

B

21:08

Deleted account

In reply to this message

Это не признак прогресса. Зачем все эти переводы по телефону, номеру карты, когда есть межбанк?

21:16

Deleted account

In reply to this message

Потому что межбанк идёт долго, стоит дорого и требует множества реквизитов

B

21:19

Deleted account

In reply to this message

Sepa бесплатно, идёт быстро. И реквизиты только одни - iban. К тому же, межбанк возвращается при ошибке в реквизитах, а перевод с карты на карту невозвратен

21:20

Ну и к переводам с карты на карту более пристальное внимание комплаенса, так как они анонимны

M

21:44

Deleted account

In reply to this message

перевод по сепе также невозвратен. А при ошибке в номере карты невозможен

21:45

In reply to this message

тоже неверно, нисколечки не анонимны. Номер карты это идентификатор платежной системы намертво привязанный к вполне себе понятному счету, просто в данном случае есть посредник - платежная система - которая выполняет свой комплайнс и отвечает за проверку переводов

B

21:46

Deleted account

In reply to this message

Если не повезло и попал случайно в алгоритм луна - перевод на другую карту пройдёт. И таки сепа возвратна, проверено на практике

M

21:47

Deleted account

In reply to this message

так и по карте перевод можно вернуть, а попасть в алгоритм луна ошибившись одной цифрой это очень маленькая вероятность... гораздо меньше чем ошибится в цифре в длинющем номере счета или одной буквой в ФИО и потом несколько дней ждать пока банк вернет перевод при плохом раскладе

B

21:48

Deleted account

In reply to this message

Неверно. Для банка-получателя это аноним и мпс не предоставляет данные сторонним банкам. Мпс не выполняет функцию комплаенса при переводах между картами. Учите матчасть, потом пишите

21:49

In reply to this message

Нельзя. Переводы с карты на карту чарджбеку не подлежат. Не вводите людей в заблуждение. И изучите матчасть

M

21:49

Deleted account

In reply to this message

я же написал там уже платежная система отвечает за передачу банковского сообщения и верность. Да, банк не видит владельца платежа. Но это не является для комплаенса красной тряпкой, там ответсвенность на платежной системе

B

21:50

Deleted account

In reply to this message

Вероятность очень высокая. Знаю множество клиентов, которые умудрялись попасть. Перевод с карты на карту НЕВОЗВРАТЕН. что лучше - подождать неделю возврата по сепе или потерять неверный к2к?

M

21:53

Deleted account

In reply to this message

хорошо, изучу. Один раз в жизни встречал что человек ошибившись на одну цифру в номере карты попал в другой банк. Правда внутри рф. Касательно чаржбеков (опять же внутри рф) что перевод по счету что по карте отзыв только через правоохранительные органы возможен - то есть какая разница? Вероятно ибан немного по другому, но тоже не встречал ни разу

21:56

ошибка на одну цифру невозможна в номере карты разве возможен по луну? минимум две

21:56

если возможна, то можно пример?

B

21:56

Deleted account

In reply to this message

Перевод по счету на ошибочные реквизиты не зачислится. И вернётся сам, без полиции. Перевод с карты на карту - зачислится. А там уже только на полицию, которая работает... Ну как работает...)

M

21:57

Deleted account

соврал кстати, на 4 цифры ошибся тогда человек. бин другого банка был

B

21:59

Deleted account

In reply to this message

Возможна. Перестановка 2 цифр. Прекратите спор и начните уже изучать вопрос. Для этого чата, полагаю, уже хватит.

А в случае с неправильным биком банк не зачислит. Сверка идёт не только по номеру счета, но и фио. И таки в номере счета зашита проверка бина

А в случае с неправильным биком банк не зачислит. Сверка идёт не только по номеру счета, но и фио. И таки в номере счета зашита проверка бина

M

21:59

Deleted account

In reply to this message

бин карты был перепутан. Первые 4 цифры от райфа были подставлены к карте сбера и такой номер прошел. Я вот что имел в виду. А не бик

B

M

22:01

Deleted account

могу даже найти тот случай. Да, для этого чата достаточно. Все таки для человека удобнее перевести моментально по номеру карты или по никнейму понятному разуму. Для исключения ошибок вы совершщенно правы полные реквизиты удобнее

K

23:04

Deleted account

Добрый вечер!подскажите плиз,через онлайн запись в иммигрейшн на семью из 2 взр+3 детей выбирать два окошка (по одному на взрослого) или 5 подряд на каждого члена семьи?

OR

23 June 2021

V

09:50

Deleted account

In reply to this message

Я не заверила перевод, просто сделала сама в свободной форме. Думаю лучше не указывать о смерти, просто переведите имя и даты. Моих уже давно нет, но свидетельство смерти никто не просил.

AD

10:02

Deleted account

Ребят, а кто недавно подавался на визу США в Никосии? Как сейчас они принимают?

EG

TB

10:24

Deleted account

In reply to this message

я прикладывала копию своего загранпаспорта и копию загранпаспорта отца+ свой пинк слип. Все приняли, сертификат выдали. Лимассол.

EG

I

10:48

Deleted account

Всем привет, я решил просто поделиться актуальными данными с которыми сегодня столкнулся. Нужно было сделать банковскую гарантию для мигрэйшн на жену и ребенку, у меня рабочая виза. В банке хелленик оформление стоит 90 евро за каждого и 550 депозит. Мне коллеги сказали, что в астробанке дешевле, я пошел к ним бранч на макариу, а оказалось что они до сентября не открывают новые банк.счета у них какая то внутренняя проверка. Мало ли кому пригодиться

OR

T

10:51

Deleted account

А оформление?

A

10:52

Deleted account

In reply to this message

3 й день уже не отвечает, кто-то слал смс туда рисентли?

B

Д

10:53

Deleted account

In reply to this message

Только что ответил на СМС отправленное в понедельник.

A

Д

10:54

Deleted account

In reply to this message

В локальном BOC 85 комиссия + 8 stamp duty на каждый депозит.

A

10:55

Deleted account

Кипрский орёл птица гордая☺️

B

10:56

Возможно, конечно, тарифы выросли, но несколько лет назад в локал хелленике было около 50 евро за все про все

S

11:15

Deleted account

In reply to this message

А можно ли так сделать, если отца на сегодня уже нет в живых? У меня сохранилась копия его паспорта.

В

11:20

Deleted account

Подскажите пожалуйста, банк гарантию потом же нужно заверять в миграционной службе?

O

11:20

Deleted account

в BoC стоит 100 евро .. тоже получается 550+ 100

N

SS

11:25

Deleted account

In reply to this message

Какие доказательства? Я своей жене, у которой family reunification permit, оформил отдельный счёт в хелленике совершенно бесплатно. Правда, мы туда сразу денег занесли в двух валютах. Но меньше десятки

В

11:26

Deleted account

In reply to this message

Кто нибудь знает как туда сейчас записаться для сверки банковской гарантии? Я не могу найти нужного пункта на сайте

OR

N

11:29

Deleted account

In reply to this message

для граждан РБ, приезжающих по приглашению на Кипр, требуется заверенная банковская гарантия

И

11:30

Deleted account

In reply to this message

С середины прошлой недели отправила 5-6 смс. Сегодня пришло 2 ответа. По какому принципу они выбирали, на какую именно смс отвечать, загадка. 🙈

A

11:30

Deleted account

In reply to this message

обычно это делали в том же окне, где выдача готовых документов. Может быть туда и сейчас обратиться?

OR

11:30

Deleted account

In reply to this message

Это для приглашения на Кипр. Не для подачи документов в мигрейшен.

Интересно, про что был вопрос 😀

Интересно, про что был вопрос 😀

N

OR

A

11:32

Deleted account

In reply to this message

Белорусам в консульство Кипра в Минске для оформления национальной Кипрской визы нужна банковская гарантия, завереная мигрейшн.

На каждую визу это заверение нужно обновлять.

Все верно.

На каждую визу это заверение нужно обновлять.

Все верно.

N

A

11:32

Deleted account

Просто народ в массе своей из России и Украины и с этим не сталкивались.

OR

11:33

Deleted account

In reply to this message

Я знаю про РБ ситуацию

Просто в вопросе у человека не было ни слова про это)

Просто в вопросе у человека не было ни слова про это)

N

11:34

Deleted account

In reply to this message

мы знаем этого человека

да и в целом ни для чего другого заверять банк. гарантию в мигрейшене не нужно

да и в целом ни для чего другого заверять банк. гарантию в мигрейшене не нужно

AL

11:35

Deleted account

In reply to this message

2 года назад в Минске когда получал визу человек, хватило только приглашения заверенного мухтаром, банк. гарантия не понадобилась (т.к. так и сказали что может без нее получится)

А сейчас что, стало строже, кто знает ? Без гемора с этой гарантией никак чтоли уже..

А сейчас что, стало строже, кто знает ? Без гемора с этой гарантией никак чтоли уже..

OR

A

11:36

Deleted account

Насколько я знаю, банковскую гарантию не требуют, если приглашение оформляет гражданин Кипра. Если не киприот, то нужно.

N

11:36

Deleted account

In reply to this message

нет, у нас оформляет приглашение киприот и всё равно нужно

A

11:38

Deleted account

In reply to this message

а вы где спрашивали?

в посольстве?

По линому опыту я раньше оформляла родителям. После получения паспорта в посольстве сказали , гарантия не нужна больше.

Но, возможно, личностный фактор влияет , у кого спросишь/кто оформляет визу.

в посольстве?

По линому опыту я раньше оформляла родителям. После получения паспорта в посольстве сказали , гарантия не нужна больше.

Но, возможно, личностный фактор влияет , у кого спросишь/кто оформляет визу.

N

A

N

11:41

Deleted account

In reply to this message

Спасибо, мы последний раз оформляли в 2018, может чего поменялось к лучшему

A

11:41

Deleted account

In reply to this message

да, уточните.

Хотя в свете последних событий, возможно, и снова ужесточат правила

Хотя в свете последних событий, возможно, и снова ужесточат правила

N

11:42

Deleted account

In reply to this message

да вроде по визам в последнее время ничего не менялось

ПP

11:42

Deleted account

Кроме РФ и Украины, во всех остальных случаях, требуют банк гарантию, заверенную Никосией

11:44

Deleted account

Кто знает, если в договоре аренды квартиры стоит сумма меньше 400€, собственник должен налог платить? Где то слышал, что до 400€ налог платить не надо...

S

11:44

Deleted account

In reply to this message

Давно хотела узнать, как ее делают. Пока обходимся одноразовыми турвизами для родни.

Просто идти в свой банк или надо сначала приглашение оформить?

И на какой срок выпускают гарантию?

Просто идти в свой банк или надо сначала приглашение оформить?

И на какой срок выпускают гарантию?

Д

N

11:46

Deleted account

In reply to this message

сначала приглашение, потом гаранию, потом с копией гарантии и приглашением в мигрейшен Никосии, там на копии ставят печать, оригинал гарантии забирают, копию и приглашение сканируем и отправляем приглашаемым

S

N

S

11:48

In reply to this message

Это от чего зависит?

От степени родства? От наличия титула на недвигу и статуса приглашающего?

От степени родства? От наличия титула на недвигу и статуса приглашающего?

N

11:48

Deleted account

In reply to this message

с титулом у родственника дают на 5 лет и гарантия не нужна

В

11:49

Deleted account

In reply to this message

Да все верно, я хочу пригласить граджанина РБ

И вот не понимаю теперь, как в мишрейшн записаться (

И вот не понимаю теперь, как в мишрейшн записаться (

N

S

11:50

Deleted account

In reply to this message

Титул есть. Но я резидент. Мне объясняли ранее, что резидентам обязательно делать приглашение для белорусов с гарантией

N

11:50

Deleted account

In reply to this message

попросите уточнить в консульстве в Минске

так как нам говорили немного другое

так как нам говорили немного другое

В

11:51

Deleted account

In reply to this message

Видимо стоит заранее сделать ковид тест? Если вдруг произойдет чудо и меня пустят

N

В

11:51

Deleted account

Понял, спасибо

S

11:54

Deleted account

In reply to this message

Мне будет проще самой написать емейл в минское консульство. Если ответят, опубликую.

12:10

Deleted account

In reply to this message

Но налог на доходы с этой суммы платить вроде не надо?! То есть получается, только отчисления в геси?!

Д

12:12

Deleted account

In reply to this message

Читал, что первые 17000 от сдачи в аренды не облагаются налогом... может не так понял

Д

12:14

Deleted account

In reply to this message

Не слышал такого, но это не значит что такого нет. Всё надо проверять.

l

12:28

Deleted account

In reply to this message

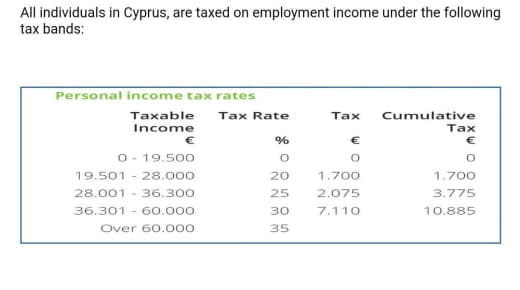

Арендный доход от сдачи недвижимости на Кипре облагается sdc и включается в расчёт по income tax, а также платится ghs с дохода за год

12:31

Deleted account

In reply to this message

А по цифрам если можно? Или ссылку на материалы, если есть возможность. Мне просто говорили, если аренда квартиры не превышает 400€ в месяц, налог не платится...

A

12:44

Deleted account

In reply to this message

дело не в сумме арендной платы, а в том, какие другие доходы есть у вашего арендодателя. Со всех дохов в совокупности (з/пл + аренда) платится подоходный по прогрессивной шкале. Первые 19,500 евро в год не налогооблагаемые. Но это ко ВСЕМУ доходу за год относится, а не только к аренде.

Если нет освобождений , то платится SDC + GESY + подоходный

Если нет освобождений , то платится SDC + GESY + подоходный

12:48

In reply to this message

TB

12:50

Deleted account

In reply to this message

Они явно не вникают в детали. Им главное где родился. Папин загран приложила просроченный на несколько месяцев

S

EG

13:52

Deleted account

In reply to this message

скажите, пожалуйста, как именно вы подавали документы? бумажные или по е-мейл?

я 2 недели назад отнесла бумажные (Пафос), неделю назад звонила - мне ответили, что если я не ожидаю в ближайшее время поступлений дивидендов, то мне и незачем этот нон-домисиль... а хотелось бы все-таки уже его получить и закрыть вопрос...

я 2 недели назад отнесла бумажные (Пафос), неделю назад звонила - мне ответили, что если я не ожидаю в ближайшее время поступлений дивидендов, то мне и незачем этот нон-домисиль... а хотелось бы все-таки уже его получить и закрыть вопрос...

TB

14:00

Deleted account

In reply to this message

У меня в Лимассоле. Выслала все по е-мейл, меньше чем через неделю перезвонили, сказали принесли оригиналы форм. При мне доделали сертификат и отдали. Они в принципе правы. Если не ожидаете дивиденды или проценты, то он вам и не нужен. Его можно запросить в любой момент

EG

VY

14:06

Deleted account

всем привет!

вопрос наверное глупый, и я догадываюсь какой на него будет ответ, но всё же:

при получении визы у Словаков, в Словакию, страна прилёта должна быть только Словакия? или можно прилететь в Вену и оттуда добраться в Братиславу?

PS

не успеваю получить визу в Венгрию. Говорят венгры им перестали отвечать и ничего по срокам сказать не могут, рекомендуют Словакию или Словению с запасом 14 дней. А билеты куплены на wizzair, который не летает в Словакию. Так что думаю: либо отменять билеты, либо менять рейс...

вопрос наверное глупый, и я догадываюсь какой на него будет ответ, но всё же:

при получении визы у Словаков, в Словакию, страна прилёта должна быть только Словакия? или можно прилететь в Вену и оттуда добраться в Братиславу?

PS

не успеваю получить визу в Венгрию. Говорят венгры им перестали отвечать и ничего по срокам сказать не могут, рекомендуют Словакию или Словению с запасом 14 дней. А билеты куплены на wizzair, который не летает в Словакию. Так что думаю: либо отменять билеты, либо менять рейс...

OR

SC

14:08

Deleted account

Подскажите, на какие сроки в среднем дают греческий шенген для резидентов (из практики)? До этого греческий шенген уже был (последний). И есть ли ощутимая разница, на какой срок дают греки и словаки?

OR

14:08

Deleted account

In reply to this message

Мне до Ковида одобряли визу в Словакию с прилетом в Вену и отелем в Братиславе.

IZ

14:08

Deleted account

Если на номер 1199 пришёл ответ что готов пластик но письма нет на мэйл не дадут карточку?

OR

VY

IZ

14:10

Deleted account

Я была вчера сказали там номер какой то в письме по которому дадут

OR

SC

14:11

Deleted account

In reply to this message

А если подаёшься второй раз подряд на греческую - охотно ли увеличивают срок?

IZ

14:11

Deleted account

In reply to this message

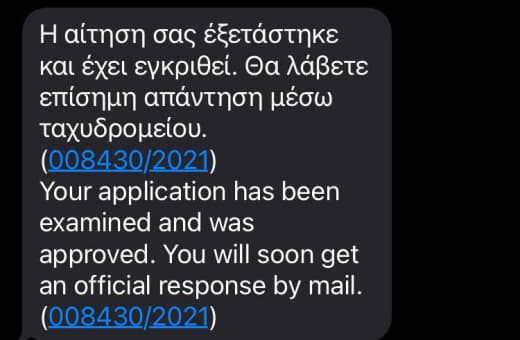

Η αίτηση σας έξετάστηκε και έχει εγκριθεί. Θα λάβετε επίσημη απάντηση μέσω ταχυδρομείου. (002611/2021)

Your application has been examined and was approved. You will soon get an official response by mail. (002611/2021)

Your application has been examined and was approved. You will soon get an official response by mail. (002611/2021)

OR

SC

OR

IZ

OR

SC

14:13

Deleted account

😂

VY

SC

IZ

14:17

In reply to this message

Я не думала,что на кипре ещё что-то на почту просто приходит .вроде в современном мире живём.

OR

14:18

Deleted account

In reply to this message

Хотя вы возможно и правы, но мой совет - сравните написание слов "mail" и "e-mail"

IZ

14:18

Deleted account

А во сколько начинает работу мтгрецшен

SC

14:18

Deleted account

In reply to this message

Иногда действительно идёт долго. Я подождал 3 недели после того, как получил смс “Your permit is valid” это значит, что карту выпустили, она готова физически. Поехал забирать сам, продемонстрировав смс.

OR

14:18

Deleted account

In reply to this message

Письмо в почтовый ящик - это валидация вашего физического адреса.

IZ

SC

IZ

SC

14:20

Deleted account

In reply to this message

Но это смс ещё не говорит о том, что карту выпустили. Смысла ехать забирать пока нет. Дождитесь следующего статуса смс.

OR

SC

14:20

Deleted account

In reply to this message

Олег Вам говорит о процедуре. Иногда мы вынуждены от них отклоняться. Кому-то доходит, кому-то нет.

IZ

14:21

Deleted account

In reply to this message

Η άδεια σας είναι σε ισχύ. (002611/2021)

Your permit is valid. (002611/2021)

Your permit is valid. (002611/2021)

SC

OR

14:21

Deleted account

In reply to this message

Давайте эту тему с письмами закрывать.

Её уже 20 раз обсудили в чате.

Есть кейсы получения пластика и без письма и отказов в выдаче.

Поиск в чате работает отлично.

Не ленитесь!

Её уже 20 раз обсудили в чате.

Есть кейсы получения пластика и без письма и отказов в выдаче.

Поиск в чате работает отлично.

Не ленитесь!

IZ

14:22

In reply to this message

Я не ленюсь.нет возможности сейчас это поднимать.но есть люди,который просто помогают и отвечают

SC

14:23

Deleted account

In reply to this message

Это последнее смс, после которого вы можете попробовать пробиться в мигрейшн и забрать карту. Но они это не любят. Обычно просят взять с собой бумажку, которая должна прийти на Ваш mail.

OR

14:23

Deleted account

In reply to this message

Вам дали все ответы сразу, но вы решили поспорить про написания слов.

Тема закрыта!

Тема закрыта!

IZ

OR

14:24

Deleted account

In reply to this message

Этот статус означает, что карта готова, находится в Никосии и скоро будет доставлена в ваш мигрейшен и затем вам придёт письмо.

SC

14:25

Deleted account

In reply to this message

Да, ты прав. Поэтому лучше подождать 2-3 недели, иначе она может не доехать в другой город, на сколько я понял.

OR

14:25

Deleted account

In reply to this message

Просто в чате есть кейсы, когда сразу после такого статуса, забирали пинкслипы в Никосии.

Y

14:33

Deleted account

In reply to this message

Я звонила в консульство, они сказали, что в этом году не дают многократную визу в связи ковид ситуацией, только однократную до 90 дней

EG

14:35

Deleted account

In reply to this message

Первый год налогового резидентства и на 17 лет вперед.

Y

14:40

Deleted account

In reply to this message

Я подавалась на греческую с пачкой годовых греческих виз, выданных в т с и на Кипре, только последняя годовая была из Словакии, с резиденс пермит до 2025 г и только что забрала 2 entry под даты поездки. Так что даже не знаю, охотнее второй - третий - пятый раз или нет. Лотерея

S

14:43

Deleted account

In reply to this message

Увы, это так((

Публикую запрос-ответ, как обещала.

*

Добрый день!

Пожалуйста, разъясните порядок оформления визы гражданину Беларуси в следующей ситуации.

Я гражданка России, имею кипрский пинк-слип и титул на собственную квартиру в городе Пафос.

Хочу пригласить в гости своих белорусских родственников (маму, брата и племянника), чтобы они могли приезжать ко мне на Кипр в любое время, когда смогут и захотят.

Какие документы требуется от меня предоставить, чтобы они могли получить долгосрочные многократные кипрские визы?

Спасибо заранее.

*

Добрый день!

Пакет документов можно посмотреть на сайте consul-kipr.by, вкладка приглашение от физлица. В Вашем случае наличие банковской гарантии для приглашаемых лиц обязательно.

Визы делаются минимум 10 рабочих дней. Прием по предварительной записи по телефону +375173680960.

На данный момент МИД Кипра приостановил выдачу многократных виз в связи с пандемией. Можно податься только на однократные визы под поездку.

С уважением,

Консульство Кипра

Публикую запрос-ответ, как обещала.

*

Добрый день!

Пожалуйста, разъясните порядок оформления визы гражданину Беларуси в следующей ситуации.

Я гражданка России, имею кипрский пинк-слип и титул на собственную квартиру в городе Пафос.

Хочу пригласить в гости своих белорусских родственников (маму, брата и племянника), чтобы они могли приезжать ко мне на Кипр в любое время, когда смогут и захотят.

Какие документы требуется от меня предоставить, чтобы они могли получить долгосрочные многократные кипрские визы?

Спасибо заранее.

*

Добрый день!

Пакет документов можно посмотреть на сайте consul-kipr.by, вкладка приглашение от физлица. В Вашем случае наличие банковской гарантии для приглашаемых лиц обязательно.

Визы делаются минимум 10 рабочих дней. Прием по предварительной записи по телефону +375173680960.

На данный момент МИД Кипра приостановил выдачу многократных виз в связи с пандемией. Можно податься только на однократные визы под поездку.

С уважением,

Консульство Кипра

👍

Д

Y

14:43

Deleted account

In reply to this message

На мой взгляд словаки лояльнее, я бы к ним лучше пошла, но когда я начинала этот процесс в мае, они мне ответили, что пока не выдают, а греки записали на подачу, поэтому я подавалась в греческое

14:45

In reply to this message

Да, мне все тоже сказали по телефону. И про гарантию при наличии титула тоже

S

14:47

Deleted account

In reply to this message

Раньше мне говорили, что если я с титулом приду в кипрское консульство рф или рб и оформлю приглашение у них, то гарантия не нужна.

Но если приглашение от кипрского резидента и заверено на кипре, то к нему нужна гарантия.

Но если приглашение от кипрского резидента и заверено на кипре, то к нему нужна гарантия.

Y

14:48

Deleted account

In reply to this message

Такая опция есть, если у вас титул и вы не резидент Кипра, в этом случае оформляете приглашение через консульство и тогда гарантия не нужна

S

14:51

Deleted account

In reply to this message

Если бы гарантию хотя бы на 5 лет оформляли, и визы долгие давали, то был бы смысл.

А сейчас выходит, что проще турвизу получать под поездку.

А сейчас выходит, что проще турвизу получать под поездку.

Д

14:52

Deleted account

In reply to this message

Попробуйте визу Хорватии, Румынии или Болгарии - может они более благосклонны к РБ?

+ может у них настоящий консул, а не почётный.

+ может у них настоящий консул, а не почётный.

Y

A

14:53

Deleted account

Подскажите пожалуйста где в Гермасое туристерии или на сироуд можно сделать перевод с греческого на английский и сразу же заверить его? Всего несколько слов перевести

Y

14:53

Deleted account

In reply to this message

Кстати, а что присходит с гарантией, когда гость уезжает? Она все равно 10 лет лежит? Или можно ее вернуть?

14:55

In reply to this message

Я бы посоветовала посмотреть список сертифицированных переводчиков на сайте pio, кто географически ближе к вам, и с ним созвониться

OR

14:55

Deleted account

In reply to this message

2-3 раза в неделю в чате обсуждают.

Да, можно вернуть.

Нет, не автоматически.

Надо писать заявление.

Да, можно вернуть.

Нет, не автоматически.

Надо писать заявление.

14:57

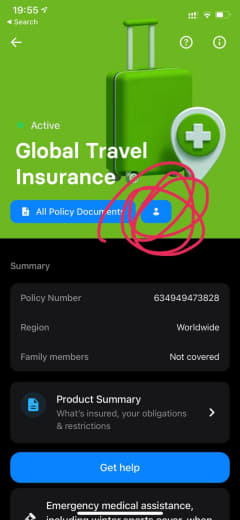

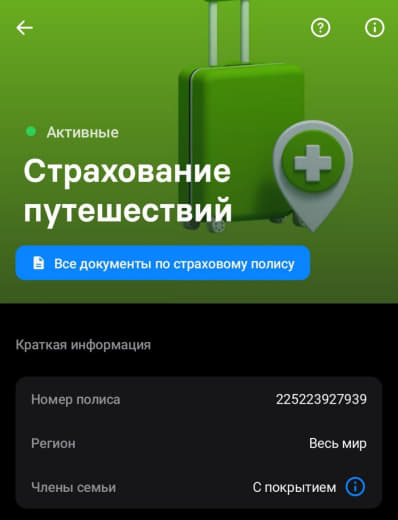

Deleted account

Может кто то скинуть контакты страхового агента в Ларнаке? Нужна страховка для подачи на пинк слип. Слышал, что можно за 150 сделать..

Д

A

14:59

Deleted account

In reply to this message

Спасибо, а эти переводчики из реестра сразу и заверить могут и не надо больше никуда ходить?

Д

Y

15:00

Deleted account

In reply to this message

Да, они сразу переводят, заверяют и больше никуда не надо ходить

N

15:00

Deleted account

In reply to this message

а как нерезидент Кипра может сделать приглашение?

разве это не "антонимы"?

разве это не "антонимы"?

S

15:00

Deleted account

In reply to this message

Все равно через тур.агентство.

Тем более сейчас. Когда Белавиа не летает.

Тем более сейчас. Когда Белавиа не летает.

SS

Д

15:02

Deleted account

In reply to this message

Я касательно сроков, вдруг лучше. Просто не разу не слышал что-бы кто-то делал для Кипра эти визы.

S

15:02

Deleted account

In reply to this message

Так уехал-приехал.

Или гарантия на каждую поездку новая нужна?

Или гарантия на каждую поездку новая нужна?

N

S

15:03

Deleted account

In reply to this message

В собственное или арендованное жилье приглашающего в гости.

Не все внж имеют.

Не все внж имеют.

N

Y

15:04

Deleted account

In reply to this message

Мне объяснили так- предположим у вам недвижимость на Кипре, но сами вы там не живете, а живете в Москве. Вы можете пригласить в свою недвижимость родственника, сделав для него приглашение, которое нужно заверить в кипрском посольстве в стране проживания. А вот если вы живете на Кипре, то несмотря на титул гарантию нужно делать….

S

N

S

15:07

Deleted account

In reply to this message

Как это? А на основании чего едет гость? Это же не провиза, где просто адрес.

Думала, после покупки квартиры будет легче. А тут ковид.(

Думала, после покупки квартиры будет легче. А тут ковид.(

N

15:08

Deleted account

In reply to this message

Если приглашающий - не-резидент острова, то и сделать банковскую гарантию тоже не может. Так что это скорее исключение из правила

S

15:09

Deleted account

In reply to this message

Ну да. А вы говорите - без приглашения.)

Без гарантии. Но с приглашением.

Без гарантии. Но с приглашением.

N

S

15:11

Deleted account

In reply to this message

В Москве мне по идее, приглашение не заверят, у них же есть данные, что я резидент.

А в Минске я не проживаю.

Замкнутый круг.(

А в Минске я не проживаю.

Замкнутый круг.(

LS

15:40

Deleted account

In reply to this message

Мы до ковида подавались в Словакию с билетами в Милан и бронью отеля в Братиславе. Сказали, что на машине поедем. Вопросов не возникло. Там же потом подавали повторно

VY

TB

15:52

Deleted account

In reply to this message

from year год вашего начала резидентства на Кипре to year + 17 лет с начала вашего резиденства на Кипре. Наример если вы резидент с 2020. Будет from 2020 to 2037

V

15:54

Deleted account

Подскажите пожалуйста дешевую страховку через инетернет для Иммигрейшен.

Д

CA

16:07

Deleted account

In reply to this message

Anytime (который теперь SoEasy), например. Она примерно одинаково стоит везде. На 10-20 евро дешевле может быть дикая франшиза.

OS

16:09

Deleted account

In reply to this message

Денис, подскажите, пожалуйста, где можно прочитать это правило ? Мне юрист сейчас говорит, что моя семья останется на фемили реюнификейшен статусе , а только у работающего на Кипре будет виза ltrp с правом работать на несколько работодателей и тп. Ссылается на разговор с мигрейшен офицером.

N

16:12

Deleted account

In reply to this message

LTRP в кипрском законодательстве имплементирован согласно директиве 2003/109/EC, которая гласит, что члены семьи обладателя статуса LTRP не могут быть ограничены в праве работы после первого года нахождения в статусе LTRP и имеют такие же права, как и обладатель LTRP

Директива https://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX%3A32003L0109

Директива https://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX%3A32003L0109

OS

N

16:18

Deleted account

In reply to this message

дополню, что мигрейшен для работающих членов семьи обладателя LTRP требует смены FR Visitor на FR Employment (или на FR самозанятого - но тут у меня опыта нет), но право на работу никак не ограничивается

SC

A

16:31

Deleted account

In reply to this message

Пенсионерам из рб ставят визу без гарантии. Что бы консульство не говорило, но дважды все ок.

S

16:41

Deleted account

In reply to this message

Делала запись на декабрь, подали на ускоренный appointment (в конце июля) - предоставили. Но было реальное подтверждение бизнес поездки

ХП

16:46

Deleted account

Добрый день! Подскажите пожалуйста, обладатели Лонг терм который на 5 лет должны уведомлять о своем ВНЖ или это только обладатели бессрочных ВНЖ должны ? Прочитала все по теме , включая статью , но так и не поняла . Заранее благодарю

N

A

16:58

Deleted account

Добрый день! Подскажите пожалуйста по поводу налогового вычета на 5 лет (если не ошибаюсь до 8550 евро в год) за первое трудоустройство на Кипре… В случае если до истечения этих 5 лет меняешь свой статус на visitor и платишь уже налоги на доход получаемый из-за границы - налоговый вычет теряется, так?

KP

17:06

Deleted account

Добрый день. Скажите, ребёнок 4г тоже должен прийти на аппойтмент в иммигрейшн? Первая подача на визитерский пинк слип.

N

17:08

Deleted account

In reply to this message

А фото на пластик как сделать? Вроде уже большой, что бы сфотографироваться

17:08

In reply to this message

вроде в законе про first employment

т.е. если уже не employment - то и льготы уже нет

т.е. если уже не employment - то и льготы уже нет

AM

17:09

Deleted account

In reply to this message

Дочка в 4 года ходила в точно такой же ситуации, но это было 10 лет назад :)

OR

A

17:11

Deleted account

In reply to this message

Вот и я тоже так думаю… Но спросила на случай если кто-то уже был в такой же ситуации 😅

KP

17:19

Ещё такой вопрос - на банковской гарантии от ВОС внизу написано Stamp duty paid. Не совсем понимаю, нужно снова марки покупать и клеить?

AU

KP

LB

19:19

Deleted account

In reply to this message

Вчера только сделал гарантию в Хеленик на жену. 550+60+8 вышло. Может конечно зависит от наличия открытого у них счета. У меня открыт у них.

EG

Y

ХП

22:19

Deleted account

In reply to this message

Спасибо, я думала, что как раз срочный, так как на 5 лет выдан. в МФЦ тоже сказали, что если не гражданство , то уведомлять не нужно . в общем буду изучать дальше тогда.

24 June 2021

Л

00:45

Deleted account

Здравствуйте! Посоветуйте пожалуйста юриста, который хорошо решает вопросы, связанные с оформлением новых пинкслипов при просроченных старых.

O

AS

07:06

Deleted account

Всем доброго утра!

Кто ближайшие месяцы пытался получить/получил итальянский шенген - Подскажите, как записывались на подачу?

Телефоны молчат, с consolare.nicosia@esteri.it тоже пока тишина - ждать просто и не нервничать, долго отвечают?

Кто ближайшие месяцы пытался получить/получил итальянский шенген - Подскажите, как записывались на подачу?

Телефоны молчат, с consolare.nicosia@esteri.it тоже пока тишина - ждать просто и не нервничать, долго отвечают?

GK

07:24

Deleted account

In reply to this message

Доброе. Странно. Без проблем записались по тел. 22357635. Все дни с 9-12, кроме среды 14-16.

AS

GK

SS

07:51

Deleted account

In reply to this message

В МФЦ сказали не нужно. А в приказе сказано уведомлять о любом ВНЖ. При этом только при личном присутствии (в том числе всех членов семьи) в подразделении МВД, либо уведомление через Почту России с описью и талончиком в качестве доказательства. Госуслуги такую услугу не оказывают. МФЦ тоже не оказывают

NS

07:58

Deleted account

In reply to this message

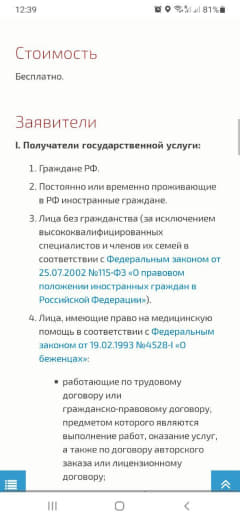

это не совсем так. в законе сказано об обязанности уведомлять о виде на жительство, позволяющем постоянно проживать в другой стране или гражданстве.

ст. 6 закона 62-ФЗ

3. Если иное не предусмотрено международным договором Российской Федерации или федеральным законом, гражданин Российской Федерации (за исключением граждан Российской Федерации, постоянно проживающих за пределами Российской Федерации), имеющий также иное гражданство либо вид на жительство или иной действительный документ, подтверждающий право на его постоянное проживание в иностранном государстве (далее также - документ на право постоянного проживания в иностранном государстве), обязан подать письменное уведомление о наличии иного гражданства или документа на право постоянного проживания в иностранном государстве в территориальный орган федерального органа исполнительной власти в сфере внутренних дел по месту жительства данного гражданина в пределах Российской Федерации (в случае отсутствия такового - по месту его пребывания в пределах Российской Федерации, а в случае отсутствия у него места жительства и места пребывания в пределах Российской Федерации - по месту его фактического нахождения в Российской Федерации) в течение шестидесяти дней со дня приобретения данным гражданином иного гражданства или получения им документа на право постоянного проживания в иностранном государстве.

ст. 6 закона 62-ФЗ

3. Если иное не предусмотрено международным договором Российской Федерации или федеральным законом, гражданин Российской Федерации (за исключением граждан Российской Федерации, постоянно проживающих за пределами Российской Федерации), имеющий также иное гражданство либо вид на жительство или иной действительный документ, подтверждающий право на его постоянное проживание в иностранном государстве (далее также - документ на право постоянного проживания в иностранном государстве), обязан подать письменное уведомление о наличии иного гражданства или документа на право постоянного проживания в иностранном государстве в территориальный орган федерального органа исполнительной власти в сфере внутренних дел по месту жительства данного гражданина в пределах Российской Федерации (в случае отсутствия такового - по месту его пребывания в пределах Российской Федерации, а в случае отсутствия у него места жительства и места пребывания в пределах Российской Федерации - по месту его фактического нахождения в Российской Федерации) в течение шестидесяти дней со дня приобретения данным гражданином иного гражданства или получения им документа на право постоянного проживания в иностранном государстве.

SS

NS

08:00

Deleted account

расшифровки, что значит "постоянно проживать" в законе нет, поэтому и возникают бесконечные споры и обсуждения.

на мой взгляд, постоянно = бессрочно, так как любой временный вид на жительство является срочным и имеет дату окончания.

на мой взгляд, постоянно = бессрочно, так как любой временный вид на жительство является срочным и имеет дату окончания.

08:02

но это мое личное мнение

Д

NS

08:04

Deleted account

In reply to this message

ага, я поэтому не участвую никогда. бессмысленно. пока законодатель не детализирует или не даст пояснения, так и будет.

или больше 183 дня например ) или на срок действия вида на жительства или .....

или больше 183 дня например ) или на срок действия вида на жительства или .....

Д

08:06

Deleted account

In reply to this message

Так для этого и не конкретизируют, всегда можно прихватить за "неуведомление".

Хотели бы по честному было-бы функция на госуслугах. Выполняется элементарно, как тест на ковид приложить.

Хотели бы по честному было-бы функция на госуслугах. Выполняется элементарно, как тест на ковид приложить.

NS

T

09:56

Deleted account

Добрый день. Подавали документы на продление визитёрского pink slip. Мужу и дочке дали visitor, а мне visitor pupil???? Это как?

N

YA

10:02

Deleted account

Добрый день! Кто-нибудь менял водительские права РФ на Кипрские за ковидные времена? Как это происходит?

Читала, что в Citizen Service center быстрее можно сделать.

Читала, что в Citizen Service center быстрее можно сделать.

AD

10:56

Deleted account

Привет! Может кто знает, для подачи на шенген какой страны не нужен пластиковый пинк-слип, а можно с желтой бумажкой?

N

10:57

Deleted account

In reply to this message

с жёлтой бумажкой - нигде

а с ресиптом о подаче на продление может получиться

а с ресиптом о подаче на продление может получиться

AD

SS

Д

SS

11:16

Deleted account

In reply to this message

Они принимают заявления, делают фото и выпускают удостоверения?

Д

11:17

Deleted account

In reply to this message

Да - только сдавать нельзя у них, обменять, заменить и документы на машину. Насколько я понял.

VB

11:18

Deleted account

In reply to this message

С ресиптом на продление австрийцы нам до коронабесия дали шенген

SS

11:18

Deleted account

In reply to this message

Обменять старые на новые или обменять российские на кипрские?

Д

11:19

Deleted account

In reply to this message

https://cypruscar.org/driving/obmen-voditelskih-prav-rf-na-voditelskoe-udostoverenie-respubliki-kipr/

SS

11:21

Deleted account

In reply to this message

Далее вам распечатают на листе формата А4 временное ВУ (на него можно сразу делать страховку) и спросят где вы хотите получить новое ВУ (в Citizen Service Center или в Road Transport Department Vehicle Inspection Center Limassol).

11:22

У меня не спрашивали, где я хочу получить ВУ

OR

Д

11:23

Deleted account

In reply to this message

Я тоже никогда не менял РФ права, но поделился ссылкой на инструкцию. Операции с правами в Citezen Centr наблюдал лично.

SS

11:24

Deleted account

In reply to this message

Существующая инструкция - вполне адекватна. Но ситизен центр тут вообще не при делах. Вернее, при делах на финальном этапе. По-любому, сначала в ТОМ идти

Д

11:28

Deleted account

In reply to this message

Значит вы лучше информированы. Инструкция лишней не будет. KEPO значит не спасёт от очереди.

SS

11:28

Deleted account

In reply to this message

То есть, ситизен центр не принимает заявлений на обмен водительского удостоверения.

Где быстрее получить? Это недостаточно точно сформулированный вопрос. Вы находитесь на воздушном шаре.

Где быстрее получить? Это недостаточно точно сформулированный вопрос. Вы находитесь на воздушном шаре.

S

11:36

Deleted account

In reply to this message

Статус бессрочный. Пластик на 5 лет выдан, его перевыпустить должны автоматом, если ваш статус не изменится.

YA

12:07

Deleted account

In reply to this message

То есть получается, что вначале нужно сделать перевод ВУ РФ на греческий. А где это можно сделать в Лимасоле, не подскажете?

SS

YA

12:23

Deleted account

Спасибо! Еще такой вопрос - действительно ли оригинал прав РФ отправляют в Россию?

SS

12:25

Deleted account

In reply to this message

Отправляют. Но могут и не отправить.

Прецеденты получения отправленных прав в Россию были.

Прецеденты получения отправленных прав в Россию были.

12:28

In reply to this message

Вообще, идите в сайпрус карз. Там эти вопросы многократно обсуждались. Вплоть до того, что сейчас нужно с собой иметь арендный договор и утилити биллы за последние месяцы

AW

12:28

Deleted account

Привет. Ребят а кто сам подавался или через агенство на пинк слип (без работы), есть примерные данные сколько надо показать денег на счету и зп на семью 2взр+3детей (маленьких) а то везде разные данные от 10к до 30к, может есть у кого такой опыт,Буду благодарен за любые советы, комментарии

SS

12:29

Deleted account

Закрытое автомобильное сообщество, правила https://t.me/c/1315261949/66048, инвайт у @CyprusCarBot

OR

12:30

Deleted account

In reply to this message

10к на подающего

+4к на каждого иждивенца

Это по правилам.

По факту чвсто принимают и в 2 раза меньше выписку.

+4к на каждого иждивенца

Это по правилам.

По факту чвсто принимают и в 2 раза меньше выписку.

YA

AW

12:34

Deleted account

In reply to this message

если я 20к покажу (на 5человек) то возможно дадут? А если не примут то можно будет заново потом податься? Сколько времени они рассматривают такие дела в среднем?

OR

12:37

Deleted account

In reply to this message

1. Да, шансы хорошие.

2. Просто попросят принести выписку с нужной суммой и все, дадут новую дату подачи

3. Как только приняли документы - вы резидент Кипра. Рассматривают от 6 до 12+ месяцев.

Вообще много ответов в закрепе и поиском по чату.

Или вот статья для вас

https://vc.ru/u/36693-oleg-reshetnikov/152969-kak-pereehat-i-zhit-na-kipre

2. Просто попросят принести выписку с нужной суммой и все, дадут новую дату подачи

3. Как только приняли документы - вы резидент Кипра. Рассматривают от 6 до 12+ месяцев.

Вообще много ответов в закрепе и поиском по чату.

Или вот статья для вас

https://vc.ru/u/36693-oleg-reshetnikov/152969-kak-pereehat-i-zhit-na-kipre

AW

AB

13:37

Deleted account

Подскажите, если ресипт на руках (из Никоссии юристы передали), но сказали фоткаться идти в Лимассольское отделение миграционки - нужно ли записываться или можно прийти в живую очередь и сфоткаться?

Т

13:44

Deleted account

In reply to this message

Добрый день! Вам удалось что-то найти по заполнению этой формы?

ХП

EG

14:05

Deleted account

In reply to this message

добрый день.... нуу, как "удалось"?... я их скачала, заполнила (одна в ПДФ - распечатала и заполнила от руки, и вторая в ворде - заполнила на компе и потом распечатала), там все несложно. один вопрос был про года нон-домисилевские, это мне вчера тут в чате подсказали....

отнесла ножками в Такс департмент, звонила потом им, мне ответили, что мне в общем-то это не надо в жизни... но раз вы очень хотите, то звоните в конце месяца.. (Пафос)

отнесла ножками в Такс департмент, звонила потом им, мне ответили, что мне в общем-то это не надо в жизни... но раз вы очень хотите, то звоните в конце месяца.. (Пафос)

Т

14:24

Deleted account

In reply to this message

Спасибо! А с переводом свидетельств о рождении (своё и отца) Вы как решили, заверяли или в свободной форме (самостоятельно)?

Ш

14:37

Deleted account

In reply to this message

И с 10к на четверых все было ок, но, опять же, я в никосии спрашивал в святая святых, они говорят 20)

EG

14:39

Deleted account

In reply to this message

я прикладывала фото загранпаспорта отца, там указано место рождения (СССР). но мне ничего по документам и не ответили - подошли или нет

Т

ДS

15:13

Deleted account

Подскажите где можно сделать обычную синюю печать в Лимассоле?

ML

ДS

Т

15:34

Deleted account

In reply to this message

Добрый день! Простите, Вам удалось найти какие-то инструкции по заполнению?

i

15:38

Deleted account

In reply to this message

isabsent, [24.06.21 15:36]

нет, сам что-то натыкал... Я послал форму, но результата не знаю, так как работодатель тоже послал и, скорее всего, по его форме меня зарегистрировали

нет, сам что-то натыкал... Я послал форму, но результата не знаю, так как работодатель тоже послал и, скорее всего, по его форме меня зарегистрировали

Т

i

Т

i

15:41

Deleted account

In reply to this message

я находил. У них в Такс Офис на Гладстоунс висит бумажка с требованием отправлять только по мылу и адреса

Т

i

15:43

Deleted account

In reply to this message

lemesosvat@tax.mof.gov.cy

Там был еще и второй е-мэйл... У этого VAT в конце - может он для компаний только подразумевается...

Там был еще и второй е-мэйл... У этого VAT в конце - может он для компаний только подразумевается...

SC

16:07

Deleted account

Скажите, сейчас в Бухарест с visitors visa спокойно пускают ?

DS

16:39

Deleted account

In reply to this message

Nicosia:

lefkosia (at) tax.mof.gov.cy

Limassol:

lemesos (at) tax.mof.gov.cy

Paphos:

paphos (at) tax.mof.gov.cy

Larnaca:

larnaca (at) tax.mof.gov.cy

Famagusta:

ammoxostos (at) tax.mof.gov.cy

lefkosia (at) tax.mof.gov.cy

Limassol:

lemesos (at) tax.mof.gov.cy

Paphos:

paphos (at) tax.mof.gov.cy

Larnaca:

larnaca (at) tax.mof.gov.cy

Famagusta:

ammoxostos (at) tax.mof.gov.cy

Т

M

18:24

Deleted account

Не подскажите русскоговорящего юриста в Лимассоле, кто поможет с открытием счета и документами на ВНЖ?

OR

18:24

Deleted account

In reply to this message

Вот обратитесь плиз

—

Семен Погосян, юрист-адвокат.

моб.: +357 99 479283 (WhatsApp, Viber, Telegram)

e-mail : symeon@pogosian.lawyer

https://www.pogosian.lawyer

Говорить что от меня

—

Семен Погосян, юрист-адвокат.

моб.: +357 99 479283 (WhatsApp, Viber, Telegram)

e-mail : symeon@pogosian.lawyer

https://www.pogosian.lawyer

Говорить что от меня

M

R

19:02

Deleted account

Чатик , такой вопрос назрел. Жил по visitors visa. Далее, выехал и заехал по провизе. Получил рабочую визу. Сейчас решил на дурака проверить статус старой visitors visa. Мне пришла СМС, что она до сих пор under process. Насколько я знаю, если что не так, то приходит статус rejected. Вопрос: аннулируется ли автоматом visitors visa , если выехал более 3 мес назад и , далее, получил рабочую визу? Слышал, что этими вопросами занимаются 2 разных отдела в иммиграции и они часто не пересекаются. Сам лично аннулировать visitors visa не просил и банк гарантию назад не запрашивал.

S

19:17

Deleted account

In reply to this message

В связи с пандемией могла не аннулироваться.

http://www.moi.gov.cy/MOI/CRMD/CRMD.nsf/All/EF9A8B1D79B0AD33C22586B9001BD499?OpenDocument

http://www.moi.gov.cy/MOI/CRMD/CRMD.nsf/All/EF9A8B1D79B0AD33C22586B9001BD499?OpenDocument

R

19:17

Deleted account

In reply to this message

А как можно это проверить? Кроме как смс написать по статусу?

GM

AB

20:31

Deleted account

In reply to this message

Потом аннулируют. Я подал на новый визитор, а старый еще в рассмотрении был. Месяца через четыре аннулировали

20:35

Такой статус появился: Η αίτηση σας έχει ακυρωθεί.

Your application has been cancelled.

Your application has been cancelled.

SC

23:07

Deleted account

In reply to this message

Кто-нибудь может подсказать, пускают ли сейчас в Румынию ?

N

SC

25 June 2021

ГШ

07:38

Deleted account

Какие страны сейчас тур визу выдают ? Шенген. Мне венгры отказали . Думаю куда ещё подать

08:23

Deleted account

In reply to this message

Италию можно попробовать они вроде заявляли что туристов очень хотят ...

SS

09:00

Deleted account

In reply to this message

Три или четыре дня назад был рассказ про удачный итальянский Шенген на полгода. Поиск рулит

MG

10:15

Deleted account

Доброе утро! Кто то в последнее время обращался в греческое посольство? Не могу ни дозвониться, ни на письмо ответ получить.

OR

10:16

Deleted account

In reply to this message

Если запустить поиск по чату - можно увидеть и такие же вопросы и ответы )

MG

10:20

Deleted account

In reply to this message

Последнее сообщение было две недели назад. Может что с тех пор изменилось.

OR

MG

10:23

Deleted account

In reply to this message

:) сорян. Искал по ключевой фразе "греческое посольство".

OR

Y

Д

10:44

Deleted account

🤝

VM

11:06

Deleted account

Добрый день. Для компании -холдинга нужно открыть счёт в банке. Есть ли в настоящее время понимание какой банк более надежный и лучше подходит для этой цели? Если не брать в учёт сложности при открытия счёта вообще.

Д

11:08

Deleted account

In reply to this message

Bank of Cyprus - самый надёжный / самый неповоротливый / самый дорогой

VM

OR

VM

11:16

Deleted account

In reply to this message

Олег, если можно, пожалуйста, в личку преимущества этого Банка. За развёрнутый ответ буду благодарен.

OR

SC

11:19

Deleted account

Дорогое удовольствие )

OR

Д

EG

12:00

Deleted account

Опыт получения non-domiciled сертификата в Лимассоле:

Заполнила анкеты TD38 и TD38QA.

Отец исчез из моей жизни еще до моего рождения, соответственно никаких документов по нему у меня не было и в анкете TD38QA я его галочкой "похоронила".

В 10:00 заполненные анкеты и копия загран паспорта матери были отправлены Georgia Stilianou на gstylianou@tax.mof.gov.cy.

В 13:56 она мне позвонила и сказала, что можно приходить за оригиналом сертификата через два дня, прихватив с собой оригиналы анкет, все остальное ее устраивает.

Сегодня посетила кабинет №1 на 2-ом этаже налоговой и забрала готовый сертификат.

#non-domiciled #нон-дом

Заполнила анкеты TD38 и TD38QA.

Отец исчез из моей жизни еще до моего рождения, соответственно никаких документов по нему у меня не было и в анкете TD38QA я его галочкой "похоронила".

В 10:00 заполненные анкеты и копия загран паспорта матери были отправлены Georgia Stilianou на gstylianou@tax.mof.gov.cy.

В 13:56 она мне позвонила и сказала, что можно приходить за оригиналом сертификата через два дня, прихватив с собой оригиналы анкет, все остальное ее устраивает.

Сегодня посетила кабинет №1 на 2-ом этаже налоговой и забрала готовый сертификат.

#non-domiciled #нон-дом

N

12:18

Deleted account

Добрый день! Кто-нибудь здесь оформлял автокредит в Хеленик банке? Тут вообще считается нормальной историей, если процесс оформления занимает уже месяц? Или это нам так "повезло" с менеджером?

V

12:21

Deleted account

In reply to this message

Оформил за 2 встречи, первая — 2 часа заняла, вторая — минут 20.

OR

N

12:41

Deleted account

Ок, спасибо

AM

12:42

Deleted account

In reply to this message

Мне одобрили через месяц, когда в нем уже отпала необходимость. Очень обиделись, мол, время тратили...

N

AM

12:50

Deleted account

In reply to this message

Нет, но, в целом, впечатление о скорости работы сформировалось )

N

12:50

Deleted account

Понятно, спасибо

BO

12:52

Deleted account

In reply to this message

крупно повезло! ...мы отнесли оригиналы анкет две недели назад, неделю назад позвонили, нам сказали "зачем вам нон-домисил, если вы не собираетесь получать миллионы?"... так что пока - тишина :(

YM

13:01

Deleted account

У кого был опыт перемещения семьи на Кипр - скажите, пожалуйста, действительно ли детям независимо от возраста необходимо делать анализ крови и манту?

N

OR

YM

13:04

Deleted account

У меня рабочий yellow slip получен, семья как dependents

OR

YM

13:05

Deleted account

Понятно, спасибо. Не хотелось 5-месячного ребенка этим мучать, но видимо придется.

26 June 2021

R

08:41

Deleted account

Добрый день !На подачу биометрического русского паспорта фото не нужны?они же их в консульстве делают ?Оплата только наличные ?

08:47

Deleted account

Здравствуйте, кто может помочь , зделать Русский паспорт, по Упрощённой программе, я с Украины,

OR

08:52

Deleted account

In reply to this message

Не уверен что на Кипре такое можно сделать.

В любом случае вам в посольство РФ, не в этот чат.

В любом случае вам в посольство РФ, не в этот чат.

09:26

Deleted account

In reply to this message

Спасибо ✌️, подскажите пожалуйста, есть какая-то группа или форум где можно спросить, или же надо записываться в посольство?

NS

09:27

Deleted account

In reply to this message

мне кажется, что консульства делают прием в гражданство только детей.

https://cyprus.mid.ru/ru/consular-services/grazhdanstvo_rf/

вот сайт консульства, пишите или звоните туда, но думаю, что вам в РФ все оформлять нужно.

https://cyprus.mid.ru/ru/consular-services/grazhdanstvo_rf/

вот сайт консульства, пишите или звоните туда, но думаю, что вам в РФ все оформлять нужно.

NS

09:29

Deleted account

In reply to this message

вот вам еще статейка, но за верность не ручаюсь

https://visasam.ru/russia/poddanstvo/poluchenie-grazdanstva-v-posolstve.html

https://visasam.ru/russia/poddanstvo/poluchenie-grazdanstva-v-posolstve.html

Д

09:33

Deleted account

In reply to this message

Всё точно :(

Остальным по упрощённой схеме надо подаваться по месту жительства в РФ :(

Остальным по упрощённой схеме надо подаваться по месту жительства в РФ :(

IR

09:34

Deleted account

Доброе утро. Подскажите, а действует ещё правило «первого въезда» через страну получения шенгена?

NS

09:35

Deleted account

In reply to this message

интересно. буду знать, что можно некоторым категориям подаваться в консульствах. но вот интересно в консульстве РФ в стране своего гражданства или можно в консульстве РФ в стране резидентства?

Д

09:36

Deleted account

In reply to this message

Так ключевое "не гражданин" если ты где-то гражданин уже только в РФ.

NS

09:37

Deleted account

In reply to this message

понятно. да еще и время сейчас такое, все может быть по-другому (

Д

09:39

Deleted account

In reply to this message

Это исключения для Эстонии, Латвии и не не признаных республик ЛНР, ДНР и т.д. там уже много людей родилось после СССР, а признаного гражданства получить не могли. Вообщем это не про Кипр.

09:40

In reply to this message

Смотря для чего. Для Кипра не важно, для Финов например важно с точки зрения последующего получения виз.

SS

09:55

Deleted account

In reply to this message

Официальный текст визового кодекса Евросоюза доступен на русском языке. Нет такого правила первого въезда в этом кодексе. А есть простой здравый смысл.

Когда вы оформляете шенгенскую визу для многократного въезда, вы подаёте соответствующие документы, касающиеся первого въезда. Если по факту первый въезд окажется другим, то это даёт повод подозревать вас в обмане государственного органа, выдавшего визу

Когда вы оформляете шенгенскую визу для многократного въезда, вы подаёте соответствующие документы, касающиеся первого въезда. Если по факту первый въезд окажется другим, то это даёт повод подозревать вас в обмане государственного органа, выдавшего визу

IR

В

12:05

Deleted account

Привет! Подскажите плиз, имея рабочую визу на Кипре, сколько времени в год можно быть не на Кипре?

A

12:07

Deleted account

(Уже нашёл) Всем привет. Кто-то может быть знает как в Никосии делать фото на визы? Есть какие-то кабинки или ателье?

GK

i

12:17

Deleted account

In reply to this message

Да, я тоже хихикал по поводу нелегитимного неписаного правила первого въезда. Пока не провели 25 минут на паспортном контроле в аэропорту Мюнхена, где хамоватая прыщавая фройляйн полицай втуляла нам, что это ich bien чуть ли не противозаконная попытка пересечения границы ЕС.

Еле сдержался, чтобы не кивнуть в сторону смиренно сидевших на лавочке в ожидании решения своей скорбной судьбы группы освобожденных женщин востока с присущим им выводком шумных детей...

Еле сдержался, чтобы не кивнуть в сторону смиренно сидевших на лавочке в ожидании решения своей скорбной судьбы группы освобожденных женщин востока с присущим им выводком шумных детей...

Д

12:30

Deleted account

In reply to this message

Не больше 90 дней в подряд, и если больше 183 в год уже начинаются заморочки с налоговой резиденцией.

SS

12:33

Deleted account

In reply to this message

В предыдущем паспорте первая виза была полугодовой итальянский шенген. Первая в чистом паспорте. Залетали через Мюнхен. Я в визовом центре специально просил однократную визу. С пограничником разговаривал не больше 5 минут: "сейчас берём машину в ойропкаре и едем в Монцамбано". - Счастливого пути

B

12:50

Deleted account

In reply to this message

Все верно. Мюнхен - вполне логичная точка входа. А вот если человек с финской визой летит через Испанию - возникает логичный вопрос и аннулирование визы. Отсюда и идёт легенда, потому что люди умалчивают конкретные случаи

12:52

Я вообще до ковида предпочитал через франкфурт/мюнхен/Дюссельдорф летать. Никогда вопросов не было, ибо логичный транзит

i

13:23

Deleted account

In reply to this message

В нашем случае виза была французская, первый въезд в Испанию (Франция отменилась по болезни). Мюнхен был не первый въезд. Но прыщавой фройляйн надо же было до чего-то до... то есть прицепиться

I

13:59

Deleted account

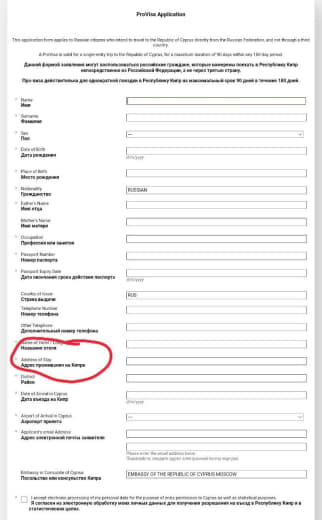

https://cyvisa.org/FL-TUR-TY.pdf заполнение flypass не поменялось ничего с мая? кто то знает?

K

16:27

Deleted account

Добрый день. Требуется консультация по визам США. Если в чате есть юристы, которые занимаются подобными вопросами - напишите, пожалуйста. Всем хорошего дня!

Д

YM

17:05

Deleted account

In reply to this message

А в чем суть заморочек? В правилах же прописан минимум 60 дней, если человек сотрудник кипрской компании.

Д

17:08

Deleted account

In reply to this message

А ечли прочитать дальше то 60 дней на Кипре, при этом не быть налоговым резидентом в другой стране / не проводить больше 183 дней.

YM

17:10

Deleted account

Ну это вроде самоочевидно. Проведение 183 дней в другой стране (в РФ в частности) как правило ведет к налоговому резидентству этой страны.

B

17:17

Deleted account

In reply to this message

Таки она была права, нецелевое использование визы. Когда VIS отладят, разговорами не отделаетесь и нелестно о немецких пограничниках отзываться не будете. Слава богу, это пока в будущем

Но, возможно, недалеком

Но, возможно, недалеком

R

O

18:44

Deleted account

In reply to this message

Вопрос, а кем я считаюсь, если подала документы на визиторский пинк-слип и на руках есть только квиток, а не карта?)

OR

O

i

20:28

Deleted account

In reply to this message

вы никогда не болеете?

Человек может заболеть и отменить поездку? И после этого что ему делать с шенгенской визой - новую получать?

Что посоветуете? Есть предложения для реальной жизненной ситуации?

Человек может заболеть и отменить поездку? И после этого что ему делать с шенгенской визой - новую получать?

Что посоветуете? Есть предложения для реальной жизненной ситуации?

OR

21:56

Deleted account

Произвёл откат чата на последний нормальный статус.

AM

OR

21:57

Deleted account

In reply to this message

Я тоже старался.

Но лучше так, чем оставлять то что было т

Но лучше так, чем оставлять то что было т

Т

21:57

Deleted account

Доброй ночи, может кто сталкивался с такой ситуацией: сегодня пришло письмо моей маме о том, что ее временный пермит готов и она может его забрать в течении 30 дней. Но письмо датировано 25/05 , т. е уже прошло больше 30 дней. Чем это может быть чревато ? П.с. В пн естественно поедем в мигрейшн, но может кто сталкивался, поделитесь опытом 🌸

AM

OR

21:59

Deleted account

In reply to this message

По идее ничего страшного.

В понедельник заберёте пинкслипы.

В понедельник заберёте пинкслипы.

Т

B

22:24

Deleted account

In reply to this message

Болею. И да, формально надо получать новую визу с актуальными маршрутами и целями

Е

23:34

Deleted account

Добрый вечер! Подскажите, плиз, что происходит с банковской гарантией, если изменился статус (был визитерский - стала рабочая). Можно ли ее размораживать?

AM

Е

27 June 2021

Ш

06:44

Deleted account

Читал чат, юзал поиск, но так и не нашел прозрачного ответа...

1. Кто-то в статусе визитера оформлял уже себя как self-employed/freelance в плане налогов?

2. Есть где-то step by step руководство как это сделать? А то столько текста перелопатил, а гайда, даже размытого, нет :-(

1. Кто-то в статусе визитера оформлял уже себя как self-employed/freelance в плане налогов?

2. Есть где-то step by step руководство как это сделать? А то столько текста перелопатил, а гайда, даже размытого, нет :-(

Д

06:51

Deleted account

In reply to this message

Так оформления нет, есть уплата налогов. "Статус" никто не даст, просто платишь налоги "приравненые" к доходам самозанятого. Вот тут самое приблежженное к мануалу.

https://t.me/cylaw/23377?single

https://t.me/cylaw/23377?single

Ш

W

10:27

Deleted account

In reply to this message

А кто-нибудь думал подавать в суд на GESY из-за их отказа регистрировать с ВНЖ (temporary permit), при том, что налоги GHS платятся немалые?

Ш

W

N

10:31

Deleted account

In reply to this message

может закончиться и тем, что отменят visitor permit (тук-тук-тук)

Ш

W

10:32

Deleted account

Совет понял, лучше просто не нужно платить GHS

L

10:32

Deleted account

In reply to this message

У вас пинкслип? Независимо платите налоги или нет, нельзя в Геси

Ш

10:33

Deleted account

Им ещё нужно разобраться с огромным кол-вом недвиги, которая висит на визитерах и пмжешках, так они и до 30 года не разгребутся)

Д

10:34

Deleted account

In reply to this message

Продление визитора будет существенно раньше чем хоть какое-то решение суда. Бесперспективность 99%. Годовая коммерческая страховка (медицина) будет существенно дешевле чем расходы на юристов.

W

N

10:35

Deleted account

Ещё в прошлом году был скандал, что в GESY не регистрировали киприотов (в большинстве турок-киприотов), которые работают на юге, платят GESY как и все, но не проживают на юге

W

10:35

Deleted account

In reply to this message

Налог просто новый, а не-регистрация - это из прошлого. Кто-то должен сделать прецендент

Д

10:38

Deleted account

In reply to this message

Маленький нюанс - ГЕСИ это не налог. Накопят этих "сборов" в фонд и подредактируют работу. 🤞🤞🤞

AB

10:41

Deleted account

In reply to this message

Геси это не налог, а сбор. Де-юре нет никакой связи между возможностью пользования ГЕСИ и уплатой взносов. Employed из 3их стран платят social tax, но пособие по безработице они не получат (в отличие от местных).

Д

10:41

Deleted account

Иски такого типа, как с ГЕСИ, мне кажется имеет смысл подавать как class action. Тогда и с деньгами и с рекламой для адвокатов может что-то получиться.

Чисто мнение дилетанта, вполне возможно что я фигню несу. 🙂

Чисто мнение дилетанта, вполне возможно что я фигню несу. 🙂

SS

Ш

AB

L

N

SS

Ш

SS

10:43

Deleted account

У жены - reunification. И она тоже в ГЕСИ

AB

SS

AB

SS

10:44

Deleted account

Про визитёров не было ни слова. Просто пинкслип

L

AB

10:48

Deleted account

Уплата налогов и сборов это одна история. Бенефиты от государства - совсем другая. Поэтому судебное дело, на мой взгляд, безнадёжно. Не платить налоги/сборы это нарушение закона, каждый пусть сам решает что с этим делать.

L

10:56

Deleted account

In reply to this message

А вот скажите, есть ещё в какой нибудь стране уплата в систему медстрахования и невозможность её воспользоваться? На самом деле это очевидная несправедливость

S

11:04

Deleted account

In reply to this message

Очевидно. Но надо посмотреть, что в других странах ЕС.

L

11:05

Deleted account

In reply to this message

А куда вы там платите и чего не получаете? Да и вообще, речь про Европу :)

S

11:06

Deleted account

In reply to this message

В РФ взносы в фомс платит работодатель или ИП. Остальные не платят, даже самозанятые.

AB

11:06

Deleted account

In reply to this message

Это не медстрахование, вы не платите страховку за себя. Это система здравоохранения - все платят взносы, а государство их распределяет. Так же и с налогами.

11:07

Deleted account

In reply to this message

таки да, но за импортного работника платит также как за местного, но омс для импортных недоступен, надо страховать отдельно...

L

11:08

Deleted account

In reply to this message

Это понятно. Так есть такое в других странах Евросоюза? Во, оказалось, в России так, ещё где?

AB

11:09

Deleted account

In reply to this message

Система "общий котел" почти везде в ЕС используется, только в разных формах. Но по сути примерно то же самое.

T

W

11:33

Deleted account

In reply to this message

Именно: деньги идут прямо в министерство здравоохранения. А оттуда - ничего не идёт

ГШ

11:34

Deleted account

Сори , что спрашиваю здесь . Когда обмениваешь русские права на кипрские , то на какой срок из дают? На тот же когда истекает пинк слип или на год стабильно ?

AB

Д

11:36

Deleted account

In reply to this message

Сами корочки на 15 лет или до 70 ваших лет, что раньше.

11:45

Ребята, если такое пришло, то как скоро может быть пластик?

S

11:48

Deleted account

In reply to this message

Омс доступен всем, кто имеет хотя бы временную регистрацию в Москве.

Лечатся в поликлиниках по месту жительства.

Или это только для россиян?

Лечатся в поликлиниках по месту жительства.

Или это только для россиян?

Д

11:50

Deleted account

In reply to this message

Это 99% работает только для граждан России для остальных есть нюансы.

11:51

In reply to this message

Ждите письма по простой почте, 2-3-4 недели не получите идти добывать так :(

J

S

Д

12:14

Deleted account

In reply to this message

А вот про РБ и не знаю, они может и не иностранцы относительно ОМС. В общем во всех странах есть дискриминация "чужих".

Отредактировал.

Отредактировал.

Т

12:19

Deleted account

Добрый день! подскажите пожалуйста Деньги которые поступают у меня на счёту в банке от зарплатой надо заплатить налоги на Кипре. Могу ли не заплатит на Кипре а заплатить налог в России есть такой закон?

AB